santa clara county property tax calculator

Santa Clara County California Property Tax Go To Different County 469400 Avg. Send us an Email.

Our Santa Clara County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States.

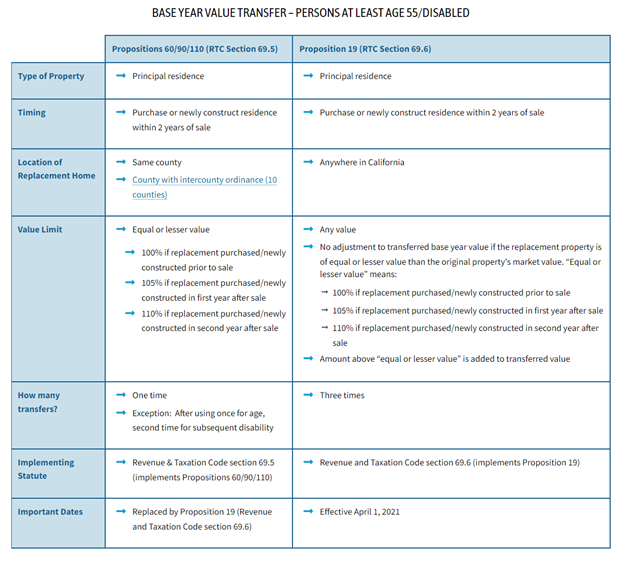

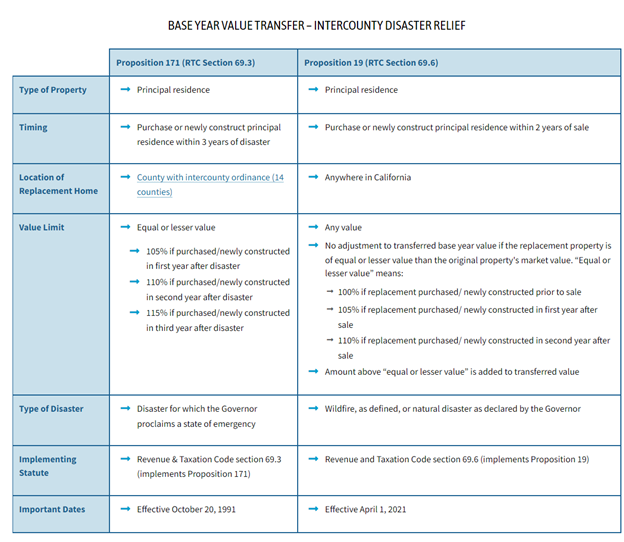

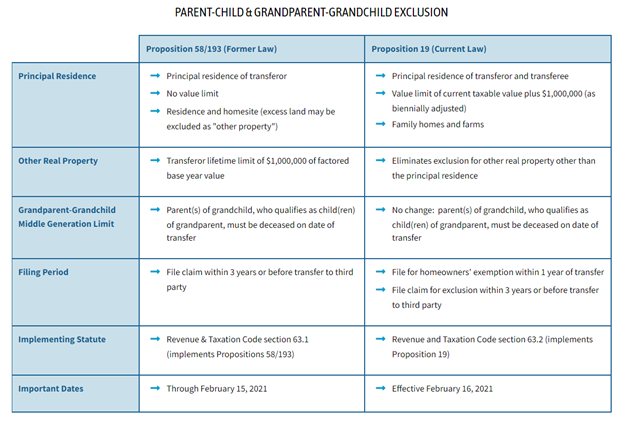

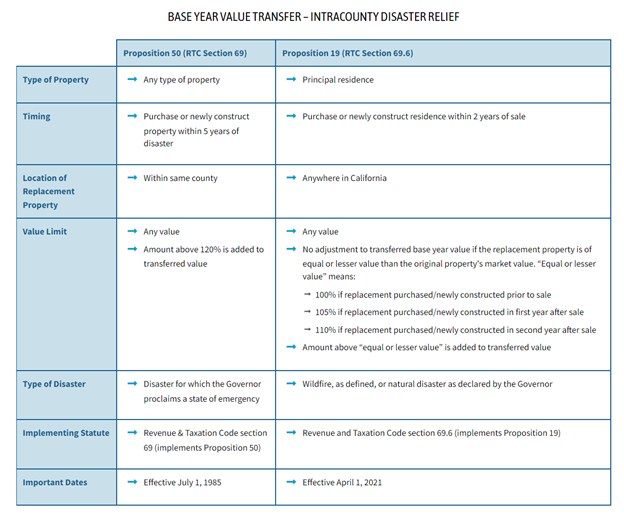

. The tax estimator is designed to help new and prospective homeowners reduce confusion concerning the amount of property taxes they can expect to pay following their purchase. The Prop 19 Estimator provides estimates of supplemental assessment s of a hypothetical transfer of ownership of principal residence from one county to another. Average Property Tax Rate in Santa Clara County Based on latest data from the US Census Bureau Santa Clara County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a property tax levy may be higher than it should be because of a distorted appraisal.

Property Tax Rate Book Property Tax Rate Book. The Prop 19 Estimator provides estimates of both the supplemental assessment s and the subsequent regular roll assessment due to a hypothetical transfer of ownership of principal residence from parent to child or grandparent to grandchild. Unsecured Taxes A vendor-added convenience fee will be charged for using a debit or credit card to make payments.

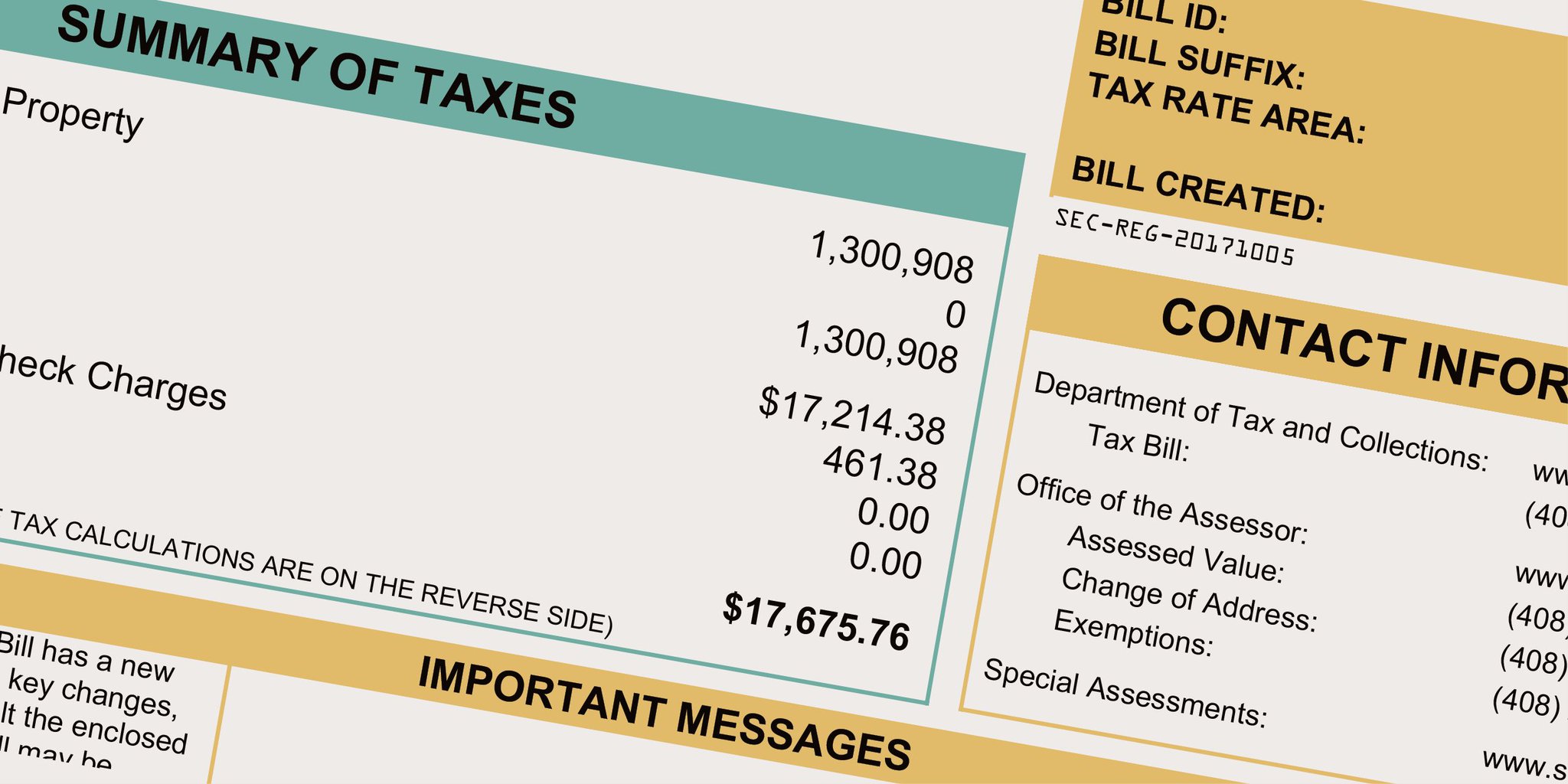

Compilation of Tax Rates and Information. Since 1300000 is greater than the 1250000 Excluded Amount there is an Excess Amount of 50000. Unsure Of The Value Of Your Property.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in Santa Clara County California. 408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Credit card services may experience short delays in service on Wednesday August 3rd from 700 pm. Santa Clara County California Property Tax Go To Different County 469400 Avg. 067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Tax Rate Book Archive. San Jose California 95110. Please enter property address I have read understand and accept the terms and conditions Advanced Address Search Search by APN Please Read.

A Baird Driskell Community Planning project built and managed by Electricbaby. 927 Average Sales Tax Summary Santa Clara County is located in California and contains around 20 cities towns and other locations. Please visit our State of Emergency Tax Relief page for additional information.

The principal residence has a full cash value of 1300000 on the date of transfer. Enter Property Parcel Number APN. Ad Get Record Information From 2021 About Any County Property.

All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. Santa Clara establishes tax levies all within California statutory directives. Typical costs to hire someone for this are.

Managing a second unit means finding a tenant and doing repairs as necessary. Additional Dwelling Unit Calculator. 12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

FY2020-21 PDF 150 MB. Find All The Record Information You Need Here. 067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Owners must also be given an appropriate notice of rate escalations. To 1000 pm Pacific time due to scheduled maintenance. Wednesday Aug 3 2022 601 AM PST.

You will need your Assessors Parcel Number APN or property address. Enter Property Address this is not your billing address. Secured Taxes Unsecured Property Businesses Boats Airplanes You will need your Assessment Number Assessors Account Number Business Name or Business Address.

FY2019-20 PDF 198 MB. County of Santa Clara. Youll then get results that can help provide you a better idea of what to expect.

This calculator is only applicable if the replacement home is being bought in the Santa Clara County and the original home is with other county intra county. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Therefore the New Taxable Value on the date of transfer is the factored base year value of 250000.

What Exactly Do You Get Pre Approved For Mortgage Blog

Why Do Silicon Valley Schools Have So Little Money Per Child By Silicon Valley Things Medium

Quick Answer How Much Is Property Tax In San Jose De Kooktips Homepage Beginpagina

How To Calculate Property Tax And How To Estimate Property Taxes

California Sales Tax Rate By County R Bayarea

Fiscal Division Office Of The Sheriff County Of Santa Clara

Orange County Ca Property Tax Search And Records Propertyshark

California Property Taxes Explained Big Block Realty

How Much Is Property Tax In California Caris Property Management

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Santa Barbara County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax And How To Estimate Property Taxes

How To Use A California Car Sales Tax Calculator

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019